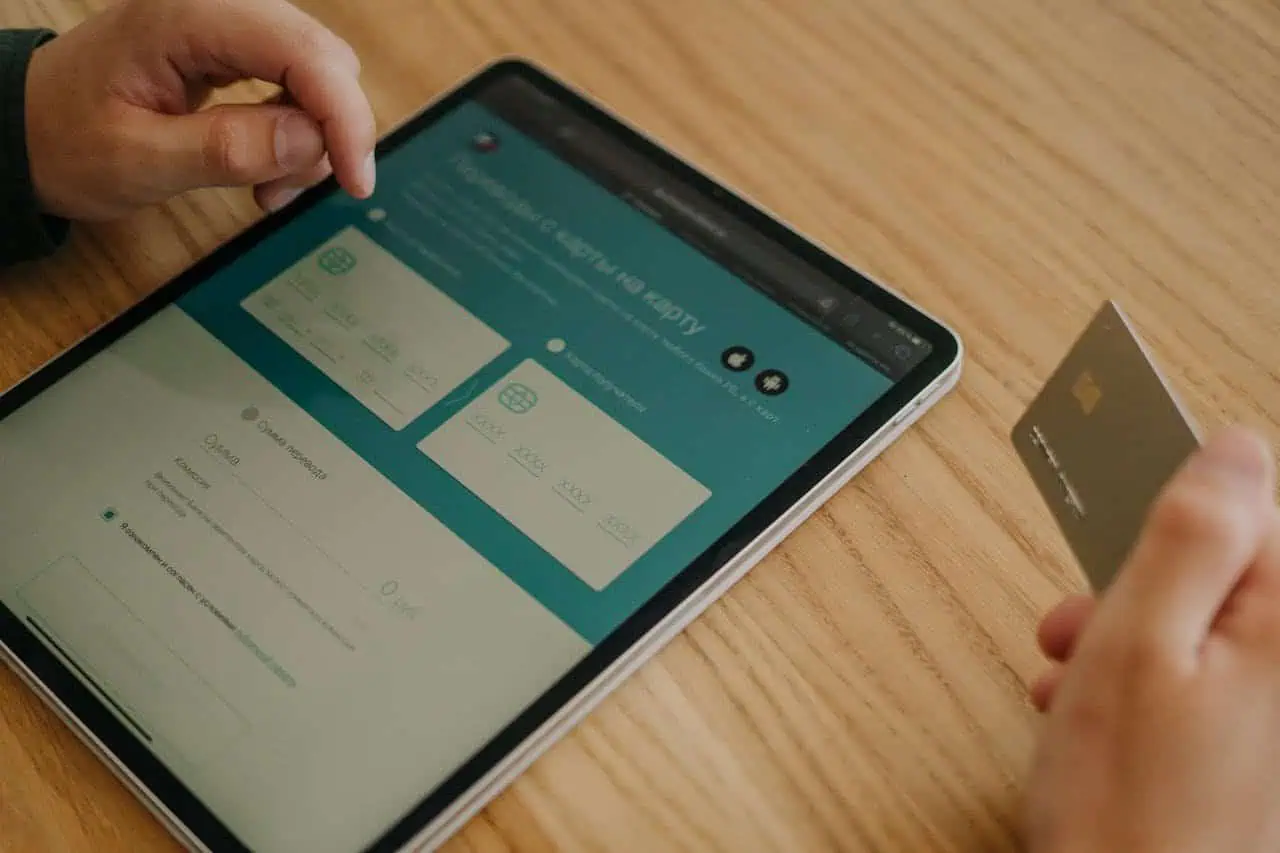

The payment landscape is evolving rapidly, with digital and mobile wallets, credit cards, debit cards, and bank transfers becoming the most frequently used payment methods in both point-of-sale and e-commerce settings. As Millennials and Gen Z are set to make up around 72% of the global workforce by 2029, it is essential for merchants to adapt to these generations’ preferences for instant, hassle-free transactions. These consumers prioritise speed and convenience, expecting their digital transactions to be quick and effortless.

To thrive in this dynamic environment, businesses must not only understand but also anticipate customer needs by delivering a frictionless payment experience that is both efficient and secure. Electronic Point of Sale (EPOS) systems enable businesses to not only benefit from frictionless payments but also track sales and real-time inventory. Specialist inventory systems are available for specific industries such as Cybertil Cloud Epos for charity retail stores.

Benefits of Frictionless Payments for Businesses

Frictionless payments are a strategic imperative for businesses looking to remain competitive. Here’s why:

- Improved Customer Loyalty: A seamless payment process enhances the overall shopping experience, encouraging customers to return.

- Reduced Cart Abandonment: By simplifying the payment process, businesses can significantly reduce the likelihood of customers abandoning the purchases.

- Increased Revenue: When transactions are frictionless, customers are more likely to complete their purchases, leading to higher revenue.

Optimising Payment Flow

To achieve frictionless payments, partnering with a reliable payment gateway is essential. This partnership is particularly crucial for businesses that operate in high-risk sectors, such as gaming, adult entertainment, travel, or international e-commerce. High-risk payment gateways offer several advantages that are vital for optimising payment flows and ensuring secure, efficient transactions. Here are some of them: https://transferty.com/high-risk-payment-gateway/

- Variety of Payment Methods

- Seamless Integration.

- Regulatory Compliance

High-risk payment gateways are designed to handle the unique challenges of businesses that face higher levels of fraud, chargebacks, and regulatory scrutiny. By providing enhanced security measures, these gateways protect businesses from potential financial losses and reputational damage. Here’s how high-risk payment gateways contribute to frictionless payments:

- Enhanced Security

- Efficient Payment Processing

- Chargeback Management

Conclusion

Nowadays, providing a frictionless payment experience is a strategic necessity. By implementing frictionless payment solutions and partnering with a reliable high-risk payment gateway, businesses can optimise their payment flows, reduce risks, and meet the high expectations of their customers. This strategy not only boosts customer satisfaction and loyalty but also drives long-term success and growth. As non-cash transactions continue to dominate, the ability to offer secure, efficient, and user-friendly payment experiences will distinguish successful businesses from the rest.